Unless you’re living under a rock (or you’re avoiding real life adult responsibilities), you are aware that it’s currently tax season. Cue the cries of horror. They say the only things guaranteed in life are death and taxes and for some people, especially wedding photographers, taxes can actually feel like death. I know they did for me early on in my business! But thankfully, tax season is pretty much a breeze now thanks to a few tools and decisions that I’m excited to share. Get nerdy with me!

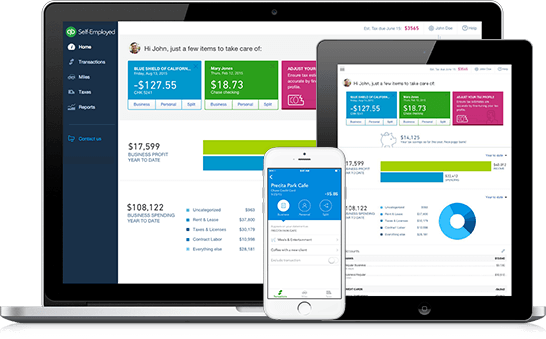

Image credit: Quickbooks

Use Quickbooks Self-Employed

This is crucial. Quickbooks is hands-down the best tool/app for small business owners like wedding photographers in terms of keeping your sanity when it comes to all things money related. For only $10/month (SO worth it!), your Quickbooks account does so much—tracks your expenses and income, logs your car mileage, creates invoices, categorizes your transactions, estimates your tax deductions, and creates the documents you need to file your end of year taxes like your income statement and Schedule C. It’s linked to your bank account so it’s extremely accurate too.

Use this link to start using Quickbooks for 50% off for your first 6 months (only $5/month!) and thank me after it changes your life!

Set Aside A Percentage of Your Photography Income For Taxes

Back in 2015 before I was even making a livable wage from my wedding photography business, a fellow photographer who had been in the game for years gave me this amazing advice: For everything you make, put 30% toward taxes, 30% toward paying yourself, and the rest back into your business. That is, if I booked a shoot for $500, I’d put $150 in a savings account that I only touch for tax purposes, I’d transfer $150 to my personal bank account, and I’d keep the rest in my business account to use to run my business. This was genius! And it helped me so much because I’m the type of person that needs to have money compartmentalized so that I don’t spend too much of it in the wrong areas. Now, depending in your needs, you may have to adjust those percentages, but I’d recommend at least 20% to go to your taxes. While I still had a full-time job, I put 30% towards taxes and the remaining amount back into my business since my day job paid me well enough.

Hire a CPA

I’ll be honest and say I still don’t fully know what the heck a CPA does, but I do know that they do what I’m not good at doing aka making sure I’m filing everything correctly and getting a chunky refund. Because I use Quickbooks and I pay taxes quarterly (did I mention Quickbooks tells me how much I should pay quarterly??), when I do meet with my CPA to file my year-end taxes, the process is SUPER easy. I just send her all the necessary documents and totals, she does her thing, I pay her a fee, and BAM—it’s done! If you don’t know where to find a CPA, try reaching out to other small business owners in your area for recommendations. I recommend Rikkia Holmes with Precision Tax and Financial Services and she works with clients in all 50 states!

Pay Quarterly Taxes

I referenced this above, but I have to reiterate how helpful this is to survive tax season. Essentially, paying quarterly estimated taxes divides the total amount you will owe at the end of the year into smaller chunks throughout the entire year. Quickbooks calculates your quarterly amount owed based on the income, expenses, and deductions you track each quarter. It even gives you the exact directions and forms needed to mail in a check or pay online when your quarterly taxes are due. This is helpful so that instead of owing (for example) $4000 by April 15, you can evenly pay $1000 every 3 months to lighten that load. In the past few years of paying quarterly estimated taxes, I’ve actually owed little to nothing at the end of year tax return because my estimated amounts were greater than needed. Helllooo bigger refund!

These are just a few things that have helped my business! I’m excited to start blogging more business tips so that small business owners can reference these posts and stress less when dealing with the non-creative side of being a photographer! Pin the image below to bookmark it as a reminder.